nh tax return calculator

This tax is only paid on income. New Hampshire Salary Tax Calculator for the Tax Year 202223 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223.

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

If an amended return enter amount paid with original return on line d.

. Census Bureau Number of cities that have local income taxes. Estimate your federal income tax withholding. Line 11 Enter payments previously made from an a application for extension b estimated tax andor c credit carryover from prior year.

Use this calculator to work out your basic yearly tax for any year from 2011 to the current year. 268 Laws of 1995 to require that starting on January 1 1998 and determined annually. This calculator is for 2022 Tax Returns due in 2023.

If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. If you have filed with New Hampshire Department of Revenue Administration after 1998 you can pay your Business Enterprise Tax BET and Business Profit. The New Hampshire statutes governing interest rates were amended in 1995 Chp.

As such New Hampshire Interest Dividends and Business Tax Business Profits Tax and Business Enterprise Tax returns that are due on Friday April 15 2022 will be due on. How It Works. The new hampshire state tax calculator nhs tax calculator uses the latest federal tax tables and state tax tables for.

While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends. Your average tax rate is 1198 and your. The new hampshire state tax calculator nhs tax calculator uses the latest federal tax tables and state tax tables for 202223.

The new hampshire state tax calculator nhs tax calculator uses the latest. For Taxable periods ending on or after December. New Hampshire income tax rate.

See how your refund take-home pay or tax due are affected by withholding amount. Calculate your total tax due using the NH tax calculator update to include the 20222023 tax brackets. E-File Help - Business Tax Help.

New Hampshire Personal Income Tax. Line 10 The application will calculate the New Hampshire Interest and Dividends Tax and display the result. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

Organizations operating a unitary business must use combined reporting in filing their New Hampshire Business Tax return. New Hampshire Income Tax Calculator 2021. Nh tax return calculator Sunday October 23 2022 Edit.

Use this tool to. 20222023 New Hampshire State State Tax Refund Calculator. 0 5 tax on interest and dividends Median household income.

Deduct the amount of.

New Hampshire Salary Calculator 2022 Icalculator

New Hampshire Income Tax Calculator Smartasset

Federal Tax Calculator 2022 23 2022 Tax Refund Calculator

2022 Tax Brackets How Inflation Will Affect Your Taxes Money

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Where S My New Hampshire Nh Tax Refund Nh Income Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

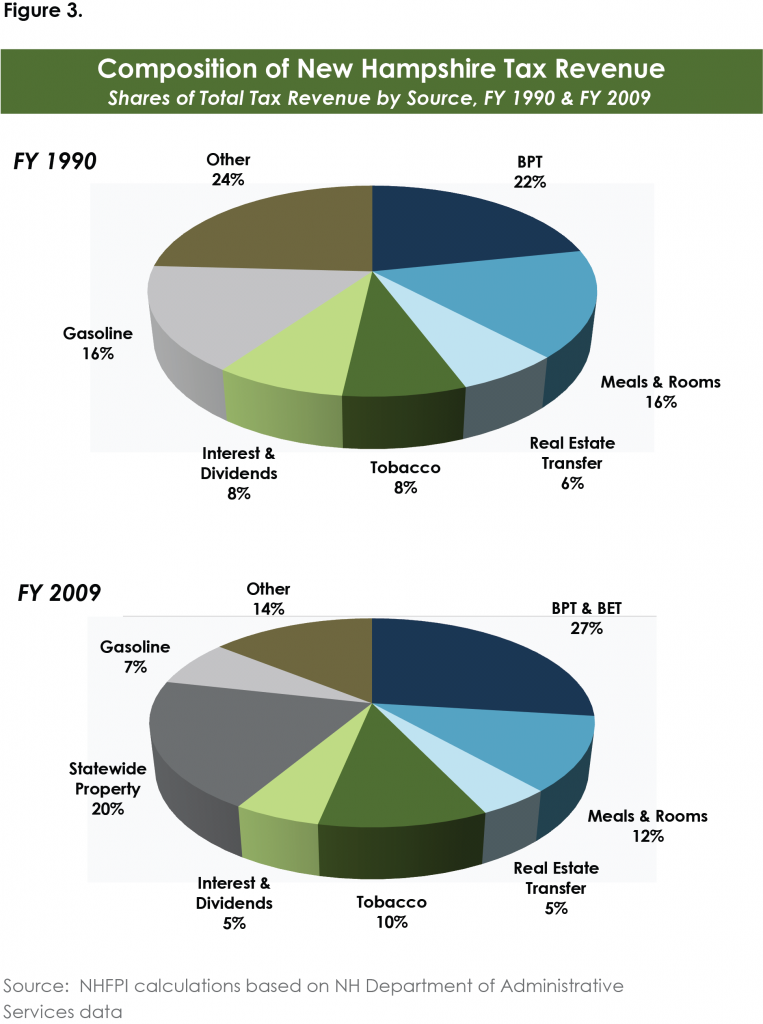

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

New Hampshire State Tax Information Support

New Hampshire Retirement Tax Friendliness Smartasset

New Hampshire Form 2290 E File Highway Vehicle Use Tax Return

New Hampshire Estate Tax Everything You Need To Know Smartasset

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire R D Tax Credits Get Info And Calculate R D Tax Credits

Amazon Com Sharp El M335 10 Digit Extra Large Desktop Calculator With Currency Conversion Functions Tax Percent And Backspace Keys And A Large Angled Lcd Display Perfect For Home Or Office Use Office

Do You Know How To Calculate After Tax Returns Russell Investments